The Impact on International Tinplate Trade from Tariff Trade War’s between USA and China , Especially in Southeast Asia

▶ Since 2018 and intensifying by April 26, 2025, Tariff Trade War’s between USA and China has had profound effects on global trade, particularly in the tinplate industry.

▶ As a steel sheet coated with tin used primarily for cans, Tinplate has been caught in the crossfire of tariffs and retaliatory measures.

▶ We here talk about the impact on international tinplate trade, and will take a focus on Southeast Asia, based on recent economic developments and trade data.

Background on the Trade War

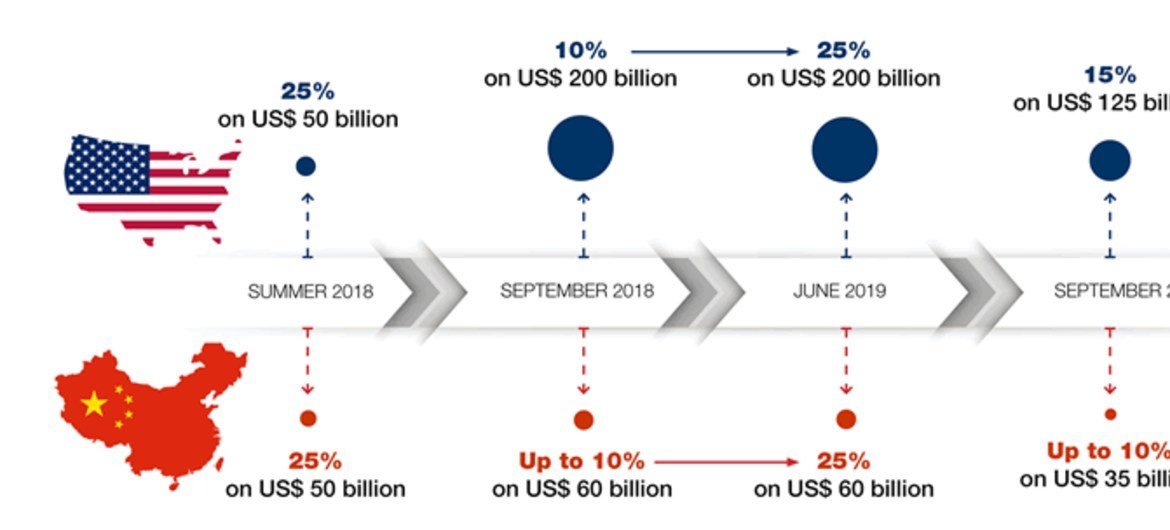

The trade war was started with the US imposing tariffs on Chinese goods, talking about unfair trade practices and intellectual property theft.

By 2025, President Donald Trump’s administration escalated tariffs, reaching up to 145% rates on Chinese goods.

China retaliated with tariffs on USA imports, which leads to a quite reduction in the trade between them, and it accounts for 3% of global trade US – China escalating trade war;

This escalation has disrupted global supply chains, affecting industries like tinplate.

USA Tariffs on Chinese Tinplate

We dealking with packaging, so we focus on tinplate, the US Commerce Department imposed preliminary anti-dumping duties on tin mill products from China, with the highest rate at 122.5% on imports, including from major producer Baoshan Iron and Steel US to impose tariffs on tin mill steel from Canada, China, Germany.

This took effective from August 2023 , and it is likely to continue into 2025. We believe Chinese tinplate is become less competitive in the US market, prompting buyers to seek alternatives and disrupting traditional trade flows.

China’s Retaliatory Response

China’s response included increasing tariffs on US goods,a rate reaching 125% by April 2025, signaling a potential end to tit-for-tat measures.

China slaps 125% tariffs on U.S. goods in latest U.S.-China trade escalation.

This retaliation has further strained the trade between them, it reduces US exports to China and will affect global tinplate trade dynamics,and both of China and United States will have to adjust to higher costs and seek new partners from other areas and countries.

The Impact on International Tinplate Trade

The trade war has led to a reconfiguration of tinplate trade flows.

With Chinese exports to the US is impeded, other regions, including Southeast Asia, have seen opportunities to replace.

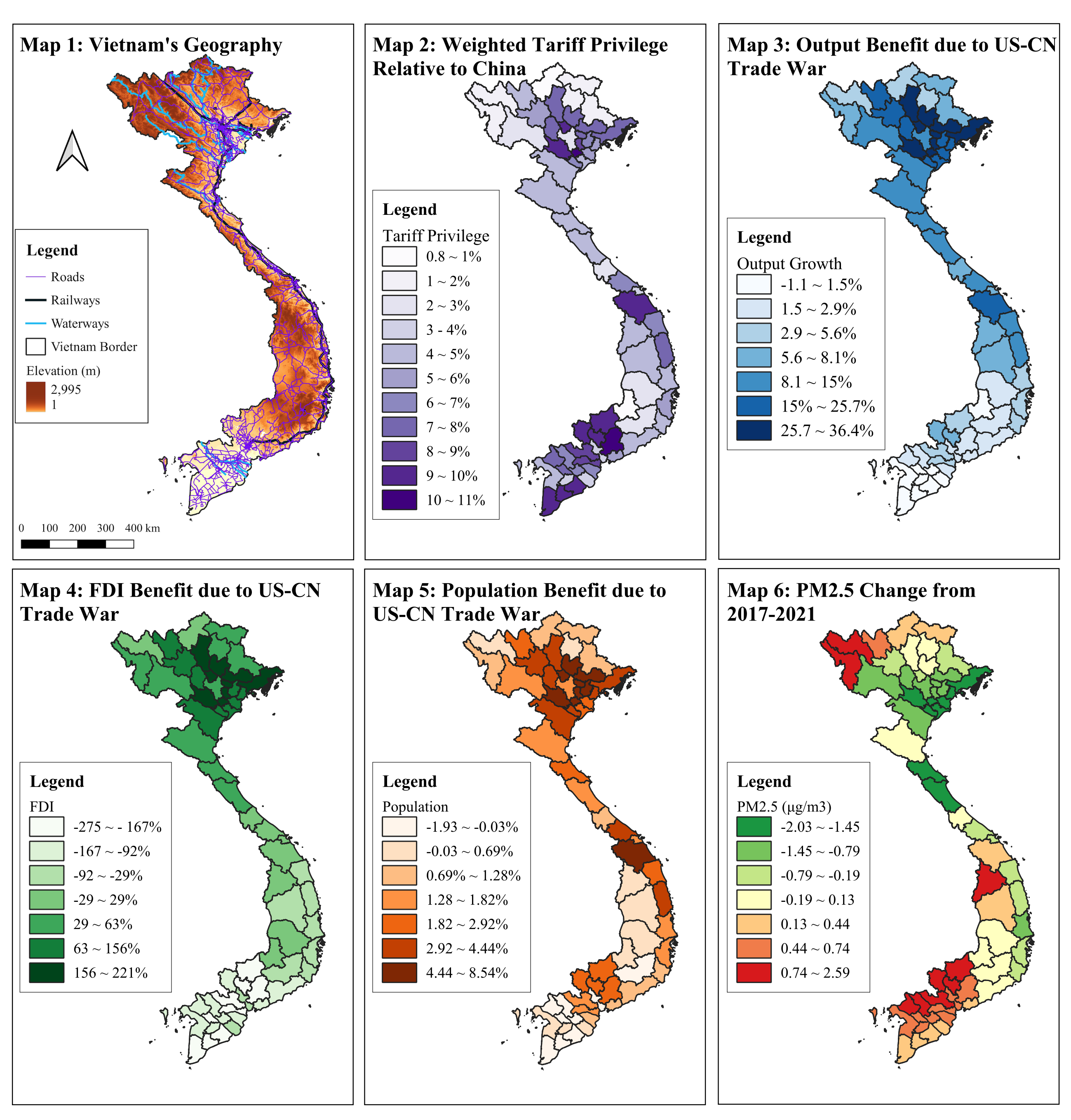

The trade war has also prompted global manufacturers to diversify supply chains:Countries like Vietnam and Malaysia will attract investment in manufacturing, as well we focus on tinplate production.

Why? when the costs get high, the transmission or immigration of the capitals will arrange its production bases to new place, and the southeast of Asia will be a good choice, where the labor cost is low, convenient traffics, and low trading costs.

Southeast Asia: Opportunities and Challenges

Southeast Asia is considered as a critical region in the tinplate trade landscape.

Countries like Vietnam, Malaysia, and Thailand have benefited from the trade war.

As manufacturers change and refind plants places to avoid US tariffs on Chinese goods.

For instance, Vietnam has seen a surge in manufacturing, with technology companies moving operations there, will make an effect on tinplate-related industries.

Vietnam manufacturing is caught in U.S.-China trade war. Malaysia has also seen growth in semiconductor exports, which could indirectly support tinplate demand for packaging China–United States trade war.

However, challenges are still come along with.

The US has imposed tariffs on various Southeast Asian goods, such as solar panels, with rates up to 3,521% on imports from Cambodia, Thailand, Malaysia, and Vietnam US Imposes Tariffs Up to 3,521% on Southeast Asia Solar Imports. when coming to solar, this trend suggests a broader protectionist stance that could extend to tinplate if exports to the US increase. On the other hand, Southeast Asia faces the risk of being flooded with Chinese goods, as China seeks to offset US market losses by strengthening regional ties, which will increase the competition for local tinplate producers. Trump’s tariffs will push Southeast Asia uncomfortably close to China.

Economic Implications and Trade Diversion

The trade war has led to trade diversion effects, with Southeast Asian countries benefiting from increased exports to both the US and China to fill gaps left by reduced bilateral trade.

Vietnam is the biggest beneficiary, with a 15% increase in exports to the US in 2024, it is bcz of the manufacturing shifts How the US-China Trade War Affected the Rest of the World. Malaysia and Thailand have also seen gains, with semiconductor and automotive exports rising.

However, the IMF warned of a 0.5% GDP contraction in emerging markets due to trade disruptions, highlighting the vulnerability of Southeast Asia US – China escalating trade war; impact on Southeast Asia.

Detailed Impact on Tinplate Industry

The specific data on tinplate trade in Southeast Asia is limited, the general trends suggest increased production and trade.

The trade war between China and USA may relocate tinplate manufacturing to Southeast Asia, leveraging lower costs and proximity to other markets.

For example, Chinese solar panel companies with factories in the region could extend similar strategies to tinplate The U.S. slaps even more tariffs on Southeast Asia, as solar panels get antidumping duties that go as high as 3,521%. However, local producers may face competition from both Chinese imports and US tariffs, which leads to a complex environment.

Regional Responses and Future Outlook

Southeast Asian nations are responding by strengthening intra-regional cooperation, as seen in ASEAN’s efforts to upgrade trade agreements US – China will response to trade war and it will impact on Southeast Asia.

China’s President’s visits to Vietnam, Malaysia, and Cambodia in April 2025 aimed to bolster regional ties, potentially increasing tinplate trade Xi’s Visit Highlights Dilemma for Southeast Asia in U.S.-China Trade War. However, the region’s future depends on navigating US tariffs and maintaining economic stability amidst global uncertainty.

Summary of Key Impacts on Southeast Asia

|

Country

|

Opportunities

|

Challenges

|

|---|---|---|

|

Vietnam

|

Increased manufacturing, export growth

|

Potential US tariffs, competition

|

|

Malaysia

|

Semiconductor export rise, diversification

|

US tariffs, Chinese goods flooding

|

|

Thailand

|

Manufacturing shift, regional trade

|

Risk of US tariffs, economic pressure

|

|

Cambodia

|

Emerging manufacturing hub

|

High US tariffs (e.g., solar, 3,521%)

|

Post time: Apr-27-2025